Fundamental Policies

- Basic approach

- Reasons for selection of the current corporate governance structure

- Officer compensation

Basic approach

The Company believes that it is essential to make prompt and appropriate business decisions while simultaneously ensuring the efficiency and lawfulness of management from the viewpoint of strengthening the competitiveness of the Company amid a harsh business environment. Our basic policy, therefore, is to provide an efficient organizational structure that can respond flexibly to changes in the business environment, to build fair and transparent management systems, and to enhance an effective corporate governance system that provides supervision and monitoring of management.

Reasons for selection of the current corporate governance structure

The Company believes it is possible to achieve appropriate corporate governance through the management structure described in the Overview of Corporate Governance Structure, and has selected the current structure from the viewpoint of effectively demonstrating a balance between executive functions and management supervision and auditing functions in light of the nature and scale of the business.

Officer compensation

A. Compensation for directors (other than Audit Committee members) was set at a maximum of 500 million yen per year by a resolution made at the 4th Ordinary General Meeting of Shareholders held on March 29, 2017. At the time of this meeting’s completion, there were six directors (other than Audit Committee members), of which none were outside directors. In addition, by the resolution made at the 9th Ordinary General Meeting of Shareholders held on September 29, 2021, the Company decided to set compensation claims for the restricted stock compensation plan provided to directors (excluding outside directors and directors who are Audit Committee members) at a maximum of 500 million yen per year, separate from the aforementioned compensation limit. At the time of this meeting’s completion, there were four directors (excluding outside directors and directors who are Audit Committee members). Stock compensation shall be granted by either of the following methods, based on the resolution at the Board of Directors on the issuance of new shares and disposal of treasury stock.

(1) Method whereby the Company’s ordinary shares are issued or disposed of as compensation for the eligible directors, without requiring that money be paid or payment in kind given.

(2) Method whereby monetary claims are paid to eligible directors as compensation, etc., and the eligible director delivers these monetary claims in entirety as payment in kind in exchange for the issuance or disposal of the Company’s ordinary shares (referred to as “contribution-in-kind delivery”).

In addition, the maximum number of shares to be granted to eligible directors has been set at 800,000 shares annually. The specific distribution to each eligible director shall be decided by the Board of Directors.

B. Compensation for directors (directors who are Audit Committee members) was set at no more than 100 million yen per year by a resolution made at the 4th Ordinary General Meeting of Shareholders held on March 29, 2017. At the time of this meeting’s completion, there were three directors (directors who are Audit Committee members), of which three were outside directors.

C. This does not include salaries for employees serving concurrently as employee and director.

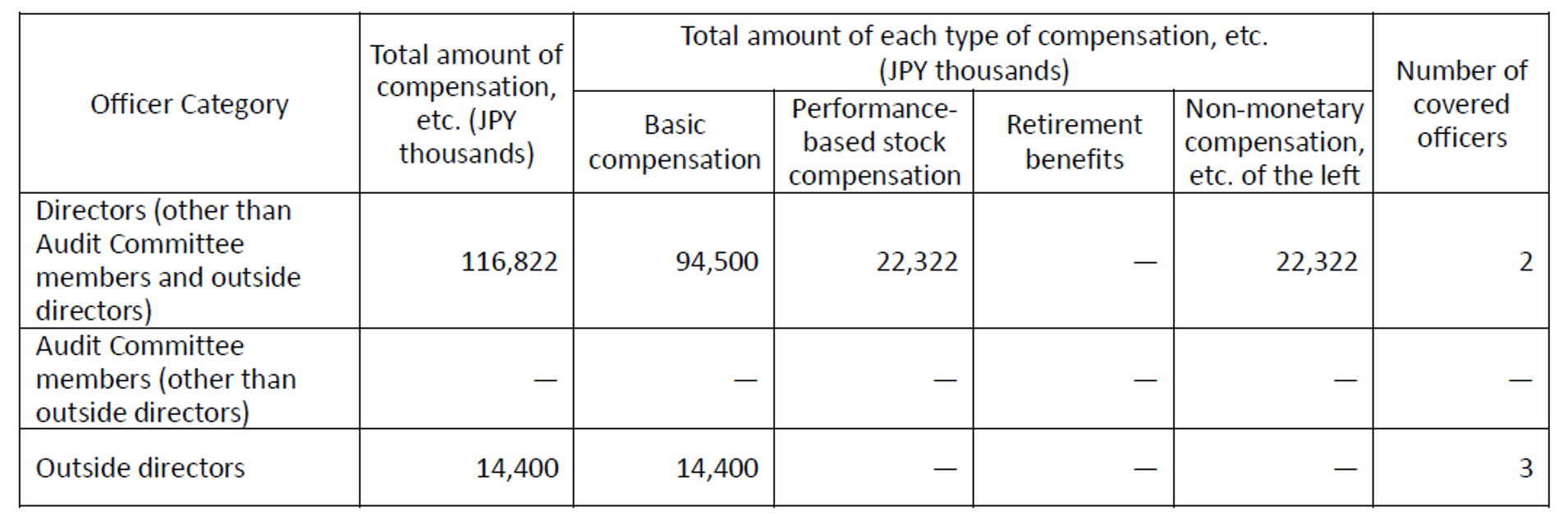

Total amount of compensation, etc. for each category of officers and each type of compensation, etc., and number of officers covered

(Notes) 1. The amount of performance-based stock compensation is the amount booked as an expense in the relevant fiscal year for restricted stock compensation.

2. The total non-monetary compensation, etc., for directors (excluding outside directors and directors who are Audit Committee members) is 22,322,000 yen in restricted stock compensation.

3. An overview of the non-monetary compensation paid to directors (performance-based stock compensation) is shown below.

(Overview of non-monetary compensation [performance-based stock compensation])

Compensation, etc., paid to the Company’s directors consists of base compensation and performance-based compensation, and the percentages for these payments are set depending on the total compensation amount, scope of supervision, etc., within a range of about 15%–30%.

(Performance-based compensation for restricted shares resolved at Board of Directors meeting held in October 2021)

The restricted stock compensation resolved at the Board of Directors meeting held on October 14, 2021, will be given as performance-based compensation until the fiscal year ending June 2024, which is the end of the medium-term management plan “DX Action 2024” announced on August 12, 2021. Total consolidated sales exceeding 24.7 billion yen during any of the accounting periods ending June 2022, June 2023, and June 2024 as determined by the Board of Directors (hereinafter, “designated accounting periods”) or total consolidated sales exceeding 69.5 billion yen over the designated accounting periods are indicators for performance-based compensation. However, the transfer restrictions on the restricted shares will not be lifted if there is a consolidated operating loss in any of the designated accounting periods or if consolidated sales declined by 10% or more compared to the consolidated sales of the previous consolidated fiscal year in any of the designated accounting periods, regardless of whether or not aforementioned indicators for performance-based compensation are achieved. In addition to indicators based on earnings, the directors must be with the Group on September 2, 2024, which is the date when the transfer restrictions on the restricted shares are lifted, and the transfer restrictions on the restricted shares given as performance-based compensation (stock compensation) will not be lifted solely by the achievement of aforementioned earnings indicators